Digital Design and Manufacturing Get Legislative Nod

The CHIPS Act and AM Forward initiative emphasize digital design and manufacturing as part of a strategy to turbocharge U.S. manufacturing and innovation.

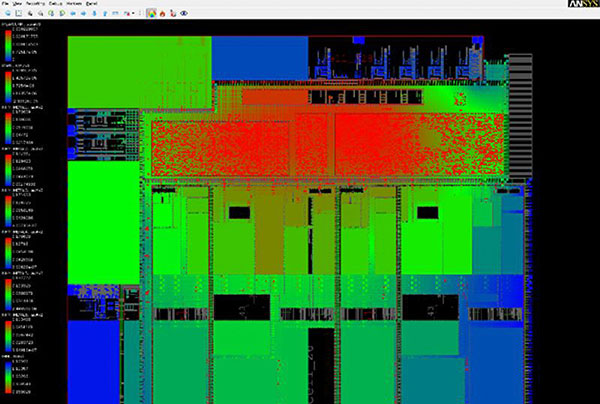

Ansys RedHawk-SC simulation software can impact automotive chip design by depicting the severity of the supply voltage drop. Image courtesy of Ansys.

Latest News

October 25, 2022

The Biden-Harris administration’s nascent legislative efforts to boost U.S. manufacturing and semiconductor production are likely to have an outsized effect on digital design and manufacturing technologies, helping to promote awareness, improve accessibility and cultivate workforce skills that should accelerate often slower adoption rates.

The two-pronged approach, anchored by the Additive Manufacturing (AM) Forward Initiative and the CHIPS and Science Act that passed this summer, are aimed at making U.S. innovation and manufacturing more competitive while driving job creation. The dual legislative efforts are designed to shore up U.S. supply chain resiliency at a time when the global economy has been peppered by product and component shortages, fueled by the COVID-19 crisis and disruptions caused by the ongoing Russia-Ukraine conflict.

“The last five years of global trade wars, the pandemic, massive conflict in Europe and geopolitical tensions have exposed weaknesses within the supply chain that previously had been limited to more functional issues that operations and engineering dealt with,” says Dave Evans, co-founder and CEO at Fictiv. “The issue escalated to a company level with the CEO and board room involved. Now, AM Forward and the CHIPS Act take everything we’ve been talking about with AM accelerating product development, just-in-time manufacturing, and digitization and turn it into a national issue.”

A Legislative Roadmap

AM Forward, designed to nurture small- and medium-sized companies to promote more resilient and innovative supply chains, is a voluntary agreement between large manufacturers, including GE Aviation, Honeywell, Lockheed Martin, Raytheon and Siemens Energy and their smaller U.S. based suppliers.

The companies have publicly committed to purchasing AM-produced parts from their smaller, U.S.-based suppliers while working with them to train workers on AM technologies, engage in standards development and certifications and provide technical assistance to streamline adoption of newer AM technologies.

The administration has also identified a range of federal programs to help smaller U.S. manufacturers address long-standing challenges associated with AM deployment, including providing access to capital and financing; delivering technical assistance from federal government programs and original equipment manufacturers; developing and investing in curriculum to train the workforce; and developing standards. De-risking AM for smaller companies has the potential to open up the technology to new audiences, improving accessibility and helping to advance more cost-effective technologies. The global market for additive manufacturing technologies, services and materials is expected to soar to $61.1 billion by 2027, growing at a compound annual growth rate of 21.8% from 2020 to 2027, according to market research.

“What this does is accelerate digital transformation whether data analytics, cloud computing, automation or 3D printing,” notes Gurvinder Singh, global products director for injection molding at Protolabs, a provider of rapid prototyping and on-demand production services. “There are a range of incentives coming that will drive those traditional organizations that have been stuck.”

Possibly more substantive is the CHIPS and Science Act, a bipartisan law aimed at boosting U.S. semiconductor manufacturing. In the wake of decades of outsourcing chip production overseas to countries like Taiwan and China, U.S. competitive advantage and leadership is at risk.

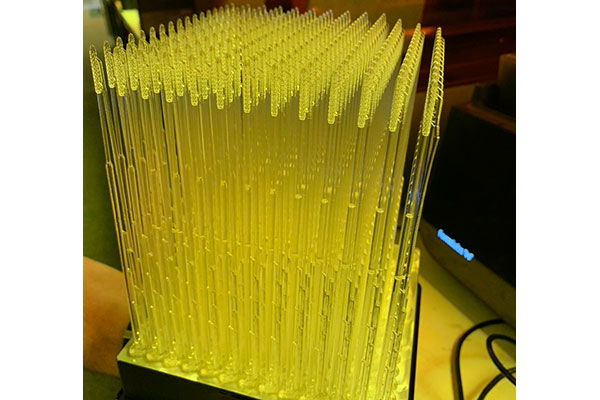

Metal AM technology is used to optimize semiconductor lithography equipment by creating wafer tables with features like cooling channels to dissipate heat. Image courtesy of 3D Systems.

According to PwC, semiconductor manufacturing capacity has fallen off from nearly 40% of capacity in 1990 to only around 12% today. Ongoing consumer demand for electronics and semiautonomous cars, coupled with companies’ digital expansion into areas like the Internet of Things (IoT) and edge computing, have exacerbated a chip shortage that was already wreaking havoc on the global supply chain.

The CHIPS and Science Act of 2022 will make nearly $52 billion in subsidies available to boost American semiconductor manufacturing while also unlocking private sector investment in factories, research and workforce development. There will be additional investment in regional innovation and technology hubs, public/private partnerships and funding for STEM education and training, including for underserved and under-resourced populations.

On the heels of the announcement, Micron Technology shared plans to invest $40 billion through 2029 to build memory manufacturing capabilities in the United States, and Qualcomm and GlobalFoundries inked a multi-billion dollar deal to increase domestic chip production as well.

As part of the CHIPS Act, funding and partnerships are also being directed at auxiliary technologies in areas such as advanced computing, advanced communications, artificial intelligence, robotics and quantum computing.

“The CHIPS Act is trying to bring back a whole ecosystem of manufacturing know-how, research and development, and design tools for developing the latest generation of chips,” says Prith Banerjee, CTO of Ansys. “Ansys can play a big role in that.”

Vendors All in on the Action

Ansys already delivers tools that can facilitate semiconductor design and fabrication. The company has been collaborating with chip leaders like Samsung and Taiwan Semiconductor Manufacturing Company (TSMC) to certify its multiphysics and power integrity solutions to support design of radio frequency chips for IoT, Wi-Fi and 5G as well as to help with thermal management challenges for 3D integrated circuit designs.

Ansys also joined the Intel Foundry Services Cloud Alliance, a standalone business looking to meet surging demand for foundry capacity with a cloud-enabled semiconductor design flow. As part of this initiative, Ansys has certified its RedHawk-SC, HFSS, Ansys Totem, Ansys PathFinder, Ansys RaptorX and Ansys VeloceRF simulation software portfolio.

Ansys also promotes Twin Builder, its platform for creating digital models as assets, as another tool to support semiconductor manufacturing by helping foundries monitor expensive equipment and flag potential problems. The Ansys hybrid solution combines a simulation-based digital twin with analytics-driven models, aiming to ensure more accuracy in depicting machine performance, according to the company.

“The hybrid digital twin can help guarantee uptime for all this multimillion dollar equipment as the fabs get prepared for a whole new world of manufacturing,” Banerjee says. “Chip fabrication is very expensive and through simulation, we can provide that golden signoff.”

3D Systems sees opportunity with the CHIPS Act to expand use of metal 3D printing for chip fabrication. Semiconductor lithography and wafer processing equipment can benefit from metal AM as they comprise highly complex parts that are produced at relatively low or medium volume, according to Scott Green, principal solutions leader at 3D Systems. 3D Systems experts are working with semiconductor companies and supply chain partners to leverage metal AM to tackle such challenges as wafer table thermal management, manifold fluid flow optimization, gas conveyance and mixing, and linear stage cooling, among other use cases.

With new legislative efforts bolstering awareness of AM and unleashing fresh funding sources, Green sees an opportunity to expand its AM presence in the semiconductor sector and develop new technology and materials offerings.

“The biggest challenge with large company bureaucracy is proving that AM can work and be better than traditional manufacturing methods,” Green explains, adding that 3D Systems is considering applying for CHIPS Act funding. “This will help us double down and prove AM is valuable.”

The nonprofit National Center for Defense Manufacturing and Machining (NCDMM) believes the AM Forward and the CHIPS Act legislation will complement its efforts to advance and accelerate adoption of AM, including as part of the America Makes network.

NCDMM, which focuses mainly on the government and defense sectors, initiates research and development projects, promotes workforce development and education, and is building a robust ecosystem as part of its strategy to accelerate the maturation and industrialization of AM, says Brandon Ribic, technology director for NCDMM and America Makes.

In addition to creating articles, course materials and other hands-on learning tools, NCDMM works with academia and industry to create programs to help operationalize AM so organizations can make high-quality, reliable parts on a consistent basis.

NCDMM has also worked with the American National Standards Institute (ANSI) on establishing AM standards—an effort Ribic hopes will be furthered by the recent legislation.

“Standards are a key component of the formula of success for industrialization of manufacturing technologies,” he says. “Publicly available standards would enable repeat efforts as AM is expanded to new cases and it also allows us to bring costs down—another important criteria for widely accepted adoption.”

As awareness of AM’s viability for production purposes grows, it also shines light on how the technology can empower more resilient and flexible supply chains. Consider a recent use case from Formlabs, a provider of professional-grade stereolithography and selective laser sintering 3D printers.

Formlabs 3D printers output nasopharyngeal swabs that were in short supply during the COVID-19 crisis, shoring up the supply chain. Image courtesy

of Formlabs.

At the height of the pandemic when nasal swabs for COVID-19 testing were in high demand and short supply, the company collaborated with University of South Florida Health’s 3D Clinical Applications Division and Northwell Health to prototype and secure materials for a 3D-printed nasopharyngeal swab.

The team was able to develop a prototype for the swab in two days using Formlabs 3D printers and biocompatible, autoclavable resins; Formlabs went on to partner with regional and international healthcare systems, medical device manufacturers and governments to print their own swabs locally, reducing supply chain bottlenecks.

“It was like a supply chain in a box, closer to where the actual need was,” says Luke Winston, Formlabs’ chief business officer.

Addressing Skill Gaps Through Funding

Another perceived benefit from the legislative action is more attention and resources channeled to develop AM-related training and educational opportunities for university and technical school curriculum as well as for corporate instruction. Given the extensive skills shortage in manufacturing, the ability to automate certain low-level tasks and upskill workers with AM competencies can increase productivity and bolster factory uptime, Protolabs’ Singh says.

Even with a significant upside, private/public partnerships resulting from AM Forward and the CHIPS Act can only go so far to course correct recent global supply chain hurdles. “Even if we reshore the supply chain and focus on just-in-time manufacturing at home, we’re still exposed at some point,” Fictiv’s Evans says. “Reshoring to the U.S. is great, but you still need to build resilience into your supply chain strategy.”

More 3D Systems Coverage

More America Makes Coverage

More Ansys Coverage

Subscribe to our FREE magazine, FREE email newsletters or both!

Latest News

About the Author

Beth Stackpole is a contributing editor to Digital Engineering. Send e-mail about this article to DE-Editors@digitaleng.news.

Follow DE