Latest News

July 1, 2018

Simulation has become a more prevalent part of design. Engineers are performing designs more frequently and much earlier in the design process than in the past, and simulations are increasingly being performed by non-specialists using tools with more user-friendly interfaces.

That focus on making simulation easier to use has led to the development of simulation platforms or ecosystems that combine multiple simulation tools into a single suite, sometimes integrated with CAD and other software. These solutions can make it simpler and more affordable to switch among different types of simulation tasks in a common environment. At the same time, new and innovative simulation tools designed for specific tasks—electromagnetic interference, composites, moldings and combustion—are being introduced to help provide better information for solving unique and often highly specialized design problems.

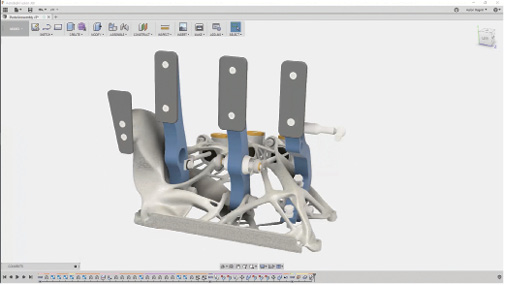

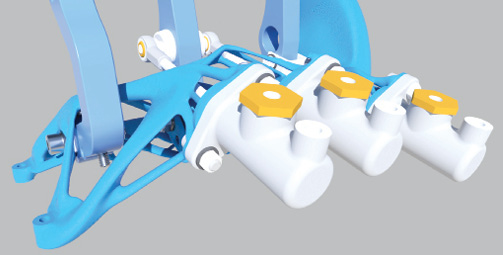

A pedal assembly is optimized via generative design in Autodesk Fusion 360 and then rendered (top to bottom). Images courtesy of Autodesk.

Design firms then are often faced with a choice of applying an ecosystem-level approach to their simulation deployments, or cobbling together a number of tools from disparate vendors. In many cases, however, companies are doing both—and software vendors are working to make this approach easier to accomplish.

Convergent Science offers a tool to address internal combustion engine simulation, primarily for the automotive market.

“I still believe that the better tool for a particular area will win over the convenience of using a tool because it works with your other software,” says Kelly Senecal, owner and vice president of Convergent Science. “The big suites can save time and be more convenient, but on the flip side, the engineer now has to make use of those tools and may be spending more time on a task than necessary because they don’t have the right tools in place.”

The big platforms also don’t always provide a truly seamless experience, in part because many of the larger players have grown their portfolios through acquisition. “These are general-purpose apps and very powerful, but using them is difficult,” says Malcolm Panthaki, founder and chief technology officer at Comet Solutions. “Despite claims that they are integrated within the platforms, if you speak to end users they are kind of integrated, but moving information between tools can be a headache.”

“Even internally, Autodesk has built a lot of our simulation portfolio through acquisition, and those were different tools that had been conceived independently,” says Brian Frank, senior product line manager in the digital manufacturing group at Autodesk. “We’re just now getting to the point where we’re really unifying the data models. It’s a tough computing problem. That’s the number one thing that’s going to face the industry as a whole, the interoperability of that simulation data so they can be used widely across users and vendors.”

However, the larger suites have improved over time and are becoming more popular with users who are exposing non-specialists to simulation activities as part of the design process. Still, experts believe engineers are likely going to require a mix of platform and purpose-built tools.

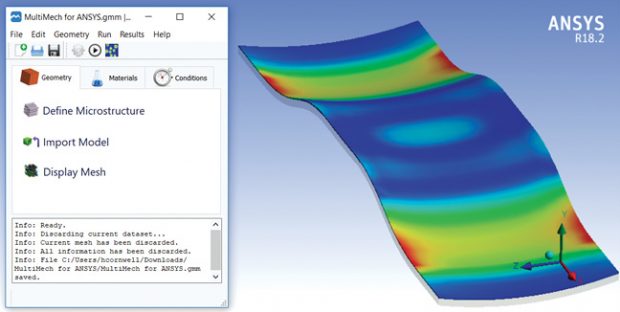

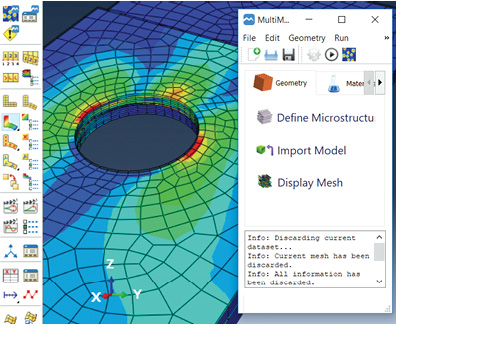

“There’s not a clear-cut line,” says Flavio Souza, co-founder, president and CTO of MultiMechanics, which provides composite material modeling solutions that the company says provide greater accuracy than more simplified tools. “We integrate with leading platforms like ANSYS and others that are focused on higher-level engineering processes and design. When it comes to predicting specific types of applications and materials, customers need more specialized tools.”

MultiMechanics’ composite material modeling solutions integrate with other platforms, such as Abaqus and ANSYS. Images courtesy of MultiMechanics.

Product sets from different vendors may also play in both ends of the simulation spectrum. Altair’s suite started out as a mesh-specific tool and has since developed into a full platform. Next year’s release of HyperWorks, though, is configured so that users can build point solutions on top of it more easily than ever. It can also be deployed in a component fashion, and there will be application-specific profiles for the platform for customers in particular industries. Likewise, the company’s Inspire product is being reconfigured to incorporate solutions such as Click2Cast, but also as an integrated system that provides multiple manufacturing solutions via the same interface.

“The cool part is you can have them all together simultaneously in the platform,” says James Dagg, CTO for Altair’s modeling, visualization and math-based solutions. “If you are designing a product, you can do a quick check on 3D printing or molding simulations on the same model in the same space.”

Likewise, Autodesk sees itself as providing more general purpose tools as well as purpose-built solutions like Moldflow for injection molding simulations. “The next generation of tools will help fuel generative design, which starts to change the equation a little bit on how simulation is being used,” Frank says. “In that scenario, users are looking to leverage both general purpose and purpose-built simulation to influence outcomes.

“If you can use simulation to help influence and inform the problem you are trying to solve, you will come out with a better outcome that will be more profitable,” Frank adds. “For a while, people were saying, ‘Let’s make the tools easier to use.’ We’ve taken a step back. Instead of making them easy to use, what if you have the technology inform the design itself, and help synthesize the geometry to solve the problem?”

Multipurpose suites are also popular with IT staff. IT departments like integrated platforms from the larger players because they are easier to manage. That desire to reduce complexity sometimes conflicts with what the engineering team wants.

“That conflict does come up, and at the end of the day our customers are still sticking with the best tool they need for the application,” Senecal says.

“End users force complexity, and not just on the engineering side,” says Mark Hindsbo, vice president and general manager of the design business unit at ANSYS. “Engineers don’t want a ‘good enough’ tool. Their customers want them to create more complex products. They are being pushed by the customer to be better, and they need the best tools to be even better. They won’t compromise for a second-best tool for the sake of it being integrated with a suite.”

Best of Both Worlds

Even simulation suite providers that offer multiple tools, CAD integration and other features recognize that the path forward will require an open approach and the ability to integrate third-party and custom solvers.

“We’re going to have customers whose needs we can’t meet because they might have niche requirements. Customers are going to want to supplement and augment those tools with their own data, processes and maybe even their own solvers or other solutions,” Autodesk’s Frank says. “We continue to look at how we can build an open enough system to bring some of that along with them and plug it into whatever tool we have created. I don’t think we’re quite there yet, but that’s ultimately going to provide value for the customer. They can have the confidence that if the tool doesn’t go the last mile, that they can build that last mile and plug it into the infrastructure. It’s not an easy thing to do but it’s the direction things need to go.”

Addressing that integration issue is at the heart of Comet Solutions’ business model, which has focused its efforts on getting tools to talk to each other, managing data and making it easier for non-experts to use simulation. “Users need a vendor-agnostic platform that can manage data, communicate with CAD and other CAE tools, and allow users to automate the processes that they wish to automate,” Panthaki says.

“We try to be as open as possible, and we provide application programming interfaces (APIs) into our products so we can drive them interactively and get at all the data,” Altair’s Dagg adds. “We have customers who use their own solvers and other products with our tools. We can configure the databases with scripting capabilities.” Altair’s partner program also provides a way for other software vendors to sell through their channel using pool-based licensing.

That integration work remains a challenge, says ANSYS’ Hindsbo, because customers are always going to raise the bar. “As soon as you solve one problem, the customer poses an even tougher problem, and this has become routine,” he says. “A customer may need three different physics solvers and they are using composite materials, and it also involves combustion and they want a real-time answer. As we give them more capabilities and more power, there are more things they want to solve. The level of effort to make that happen stays the same. It has never been easy.”

As a point solution provider, Convergent’s Senecal says it has been important for his company to integrate and work with other types of niche simulation tools, as well as with the larger suites. The company has coupled its tool with Gamma Technologies’ GT-Suite and Abaqus FEA, for example.

“Engineers want the best tool for the application, and they want the best answer they can get from their simulations,” Senecal says.

The decisions companies make about which tools to deploy and just how closely integrated the different solvers and solutions need to be will be increasingly important as more firms move toward full-system simulations.

“We don’t want to disrupt the engineer’s workflow,” says Souza at MultiMechanics. “They already know how to use those larger platforms. Our main challenge lies in how well we can integrate with those different tools.”

Hindsbo at ANSYS adds that this need for simulation tools to solve a wider variety of more complex problems has been further complicated by the demand for tools that are simpler for non-specialist end users. “As soon as we think we have delivered something, the next problem comes up,” Hindsbo says. “How do we take the complexity and provide it with an interface that is almost like a Google search, so users can ask a question in a common language and search for an algorithm to figure it out?”

A hybrid approach that leverages the benefits of a suite (integrated product lifecycle management and CAD interoperability) and the capabilities of specialized tools will be appealing to many firms. Even those who opt to use several different point solutions will likely need a third-party tool of some sort to help coordinate simulation activities.

“I see a need for the type of specialized solution we provide, but we also need people thinking about the overall scheme of the design using these platforms and how the different tools will be connected to each other,” Souza says. “It’s important to have both, because the design problems are complex enough that we need more brains involved to solve them.”

For More Info

Subscribe to our FREE magazine, FREE email newsletters or both!

Latest News

About the Author

Brian Albright is the editorial director of Digital Engineering. Contact him at de-editors@digitaleng.news.

Follow DE