Latest News

June 1, 2018

In March 2017, as he got ready to step down from his post as CEO of Autodesk, Carl Bass discussed his legacy with DE (“Carl Bass’ Parting Shots,” March 8, 2017). Asked to identify some of the biggest risks he had taken in his reign, he said without hesitation, “The move to pure subscription.”

In mid-2015, Autodesk began issuing advance warnings to the media and customers about the shift that was coming. February 2016—that was the point of no return. After this date, Autodesk would only sell products on subscription licenses—no more perpetual licenses.

Autodesk isn’t the only design software firm that made the move to subscription. Its three biggest CAD rivals—SOLIDWORKS, PTC and Siemens PLM Software—now all offer various types of subscription licensing options for some of their products. But what made Autodesk’s move particularly bold was its decision to eliminate the long-established perpetual model altogether, leaving future buyers with subscription as the only option.

It’s been two years since Autodesk and its customers crossed the deadline. It’s time to check in, to see if subscription is gaining momentum or losing steam.

Natural Fit, Retrofit

Coming online as public beta in 2015, the software-as-a-service (SaaS) CAD software Onshape was architected from the ground up to run in the cloud. “In the future, a few years from now, we’ll see engineers and designers expecting naturally to go to any computer—their phone, their web browser—and have access to a powerful CAD system and all their CAD data,” says Cofounder and CEO Jon Hirschtick. “I don’t think people will still be asking whether CAD can be done on a browser, a phone or from the cloud.” Autodesk stopped selling perpetual licenses in February 2016. Today, the only purchase option is subscription. Image courtesy of Autodesk.

Autodesk stopped selling perpetual licenses in February 2016. Today, the only purchase option is subscription. Image courtesy of Autodesk.For cloud-hosted CAD startups like Onshape, subscription licensing seems like a natural fit. The company has never had a pool of perpetual license owners, therefore no one could cry foul at the sales model.

On the other hand, for vendors who have historically sold their products in perpetual licenses, the subscription model is more a retrofit, something they—and their customers—have to adapt to. Most of them now offer both options: subscription as well as perpetual.

Even with that industry standard, Autodesk still decided to cut the cord. “While we knew we would face some resistance because we were introducing something new, we built the program based on requests from many of our maintenance customers. They wanted a path to subscription that gave them value for their previous investment and kept them current,” says Teresa Anania, senior director of Subscriber Success at Autodesk.

The success of Autodesk’s transition depends on two factors: The ability to convince perpetual license holders to switch to subscription and simultaneously attracting new subscribers. “We are encouraging enterprise customers to move to one of our subscription offerings,” says Anania. “Our preferred offering for large customers is an enterprise business agreement (EBA).”

Autodesk’s EBA, Anania explains, provides flexible access to an expansive portfolio of Autodesk products through Token Flex, a usage-based subscription model; and a Customer Success Program that includes a range of consulting and/or support services based on the customer’s business needs.

“The conversion from perpetual to subscription exceeded our expectations—in fact, it more than doubled our estimates. In Q4 of 2017 alone, we had 168,000 maintenance customers convert to subscription,” says Anania.

In Case of Power Outage

Long-time SOLIDWORKS user Richard Williams, nicknamed “Corporal Willy” by his peers in the user community, is originally from Brooklyn, NY. The former marine went to work for the Grumman Aircraft Engineering Corporation after his honorable discharge. He currently lives in Las Vegas, NV, spending his retirement promoting STEM (science, technology, engineering and mathematics) education in the local school district.“The only things that should be in the cloud are the angels,” he quips, revealing his reservations for SaaS CAD. “I do prefer having a licensed perpetual copy of my programs loaded onto my own computers.”

His dreaded scenario is a long stretch of internet outage, leaving him with no access to browser-based CAD. The fate of the Puerto Ricans left without power following Hurricane Marina, he says, “should have been a wakeup call” for the SaaS CAD advocates.

In the unlikely scenario of a long power outage, the workstation itself will become inoperable; therefore, the software, whether in the cloud or on the machine, will be inaccessible. In case of an extended internet outage, thick-client subscription CAD programs like SOLIDWORKS and Autodesk Inventor will still be operable, so long as the subscriber has a way to check in and validate the subscription at least once within 30 days.

“If you already know a program very well but cannot afford to buy an outright number of perpetual licenses for your workers, [subscription] might be the way to go on a temporary basis,” adds Corporal Willy. “[But] I still believe that over a period of time it might be more expensive for a young business.”

Perpetual Licenses with Maintenance Plans

The math for perpetual software vs. on-demand subscription is similar to buying a car vs. renting one, or using ridesharing in times of need. To someone who regularly commutes and uses the vehicle heavily, paying a one-time fee for perpetual ownership makes more sense. To those who need to use the vehicle infrequently, semifrequently or only for a set period, renting or paying a usage-based fee makes more sense.In the case of subscription software, tallying up the incremental usage fees paid over a long period of time—say, 15 to 20 years—will definitely add up to more than the one-time cost of a perpetual license. But many subscribers may see the chance to skip the steep upfront acquisition fee as an offsetting benefit in itself.

The truth is, most perpetual CAD licenses come with a subscription-like maintenance plan—the fee you must pay to keep receiving updates, new features, bug fixes and support. Two years ago, when Autodesk still sold perpetual licenses, AutoCAD was available through the company’s resellers for roughly $4,200. But in addition to this one-time cost, you would also need to pay roughly $1,300 for yearly maintenance. Currently you can get an AutoCAD subscription for $1,575 a year or $195 a month.

A perpetual license of SOLIDWORKS Standard is usually $3,995. But you would also need to pay the annual maintenance fee, roughly $1,300, to receive upgrades and support. SOLIDWORKS is now also available under term licensing, for three months or a year. The exact SOLIDWORKS term license prices are difficult to find, since neither SOLIDWORKS nor its resellers publish them. The quote is given upon contact.

The Battle in the 2D Front

Some Autodesk rivals see a chance to undercut the CAD giant in the uncharted waters of subscription pricing. Graebert, which develops the 2D drafting and drawing program ARES, believes AutoCAD perpetual licensees who are not too keen to move to subscription may look favorably at ARES as a candidate for replacement. The company offers ARES both as subscription and perpetual licenses.“Our strategy is to keep offering both perpetual and subscription licenses,” says Cédric Desbordes, sales and marketing executive, Graebert. “The customers can decide.” This March, Autodesk launched AutoCAD 2019. Soon afterward, Graebert published a video clip on LinkedIn, highlighting the price comparison between AutoCAD and ARES Commander.

“It has not been easy for us to keep offering choices,” says Desbordes. “Combining mobile and cloud with desktop [what Graebert describes as the Trinity of CAD] is a challenge when it comes to perpetual licenses. Indeed, mobile apps are frequently updated, and the app store and mobile apps in general are not adapted to perpetual licenses.”

Simulation by Subscription

In March, when simulation software maker ANSYS launched its new product ANSYS Discovery Live (ADL), it also did something unprecedented with its licensing: offering it only under subscription. ADL is, in fact, the only product ANSYS currently offers under the subscription model, but if it proves to be a hit, the company might be tempted to apply the subscription model to other products.“This really is a matter of the right licensing for the right solution,” explains Mark Hindsbo, VP and GM of ANSYS. “ADL is an end-user tool that hopefully becomes as pervasive as Excel for engineers. As such, subscription is a very appropriate mechanism.” GPU-accelerated and powered by direct editing, ADL is developed for the design-centric user pool, different from the expert simulation user pool that ANSYS targets with its higher end products.

“We believe in choice, and for most products we offer both license models. Some customers prefer to buy an asset when they buy software—these customers chose perpetual. In general, however, we are seeing a slow increase in the share of customers who prefer lease,” says Hindsbo. ADL comes in three different editions: Essential, Standard and Ultimate. Annual subscription prices are from $1,195 per year to $5,995 per year.

Consumption-Based Pricing

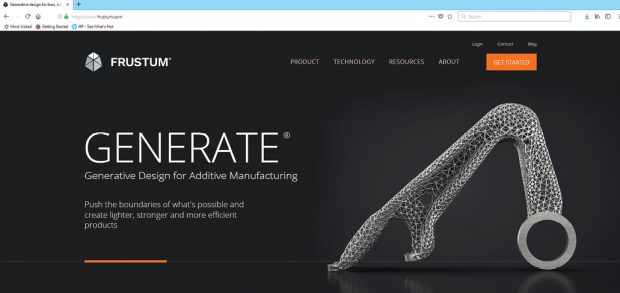

Also on the rise is the type of simulation that caters to the digital twin market, for manufacturers who wish to manage real products through digital replicas. “Here, the product could be more consumption-based licensing, device-based licensing or even revenue sharing models that would be more appropriate,” Hindsbo says. Newer startups such as Frustum are experimenting with a subscription plus usage model, combining a mix of job processing credits and subscription fees in its licensing. Image courtesy of Frustum.

Newer startups such as Frustum are experimenting with a subscription plus usage model, combining a mix of job processing credits and subscription fees in its licensing. Image courtesy of Frustum.Newer topology optimization software vendors seem to favor the subscription model, with a usage component added to it. Frustum Generate, for example, offers its software Generate Professional for $100 per month, augmented by a usage credit plan.

The Generate software is accessible from the supported browser (Google Chrome); no installation is required. Under Frustum’s Pay-as-You-Grow plan, you get 100 monthly credits with the subscription setup. The credit consumption depends on the optimization jobs you run and the number of jobs you execute.

The subscription plus usage model makes sense for optimization software because it requires both access to the software and access to computing power. The more complex the optimization, the more computation it demands. Because the software runs in the cloud SaaS-style, the required computation can conveniently be delivered from the cloud as well. The same pricing model may work well for simulation software vendors who make the cloud an integral part of the offerings.

nTopology, another startup, released the first commercial version of optimization software called Element in early 2017. The software is offered under an annual subscription plan.

“As a CAD user myself, I really appreciate when my tools get better over time. Sure, it’s nice to think of a software purchase as a one-time capital expense, but if I can trade the one-time purchase for something that improves as I use it, I definitely will,” says Spencer Wright, who oversees nTopology’s product roadmap. “As a CAD vendor, I can honestly say that the incentive structure of the subscription model is real. It pushes us to continuously improve our core functionality and provides a built-in rhythm for soliciting and integrating our users’ feedback.”

Bellwether or Short-lived Fad?

In the era of Netflix streaming and Google Drive, perpetual licensing seems quaint. Yet, in the design software business, subscription is not the norm—not yet, at any rate. It’s more of an exception to the rule, an emerging trend.In enterprise and consumer software markets, Salesforce.com, Adobe Creative Cloud, Quickbooks and Microsoft Office have paved the way. They exemplify the shift from desktop to the cloud, from perpetual license to usage-based subscription models. But some of the transitions have not been silky smooth.

In 2013, when Adobe switched from perpetual off-the-shelf software to subscription-only with the launch of Adobe Creative Cloud, the move was met with backlash. History suggests turbulences and upheavals may be unavoidable for any established design software vendors that make a notable change like Autodesk.

However, Autodesk gave its customers plenty of advance notices, with programs designed to ease the transition. Currently, most of Autodesk’s rivals offer both types of licenses. In the future, if subscription becomes more widespread and acceptable, perpetual licenses may fade away, becoming a legacy of the past.

One of the key components to Autodesk’s switch may be its resellers—those who provide sales and support at the frontline. Their ability to adapt to the new model or the failure to do so could accelerate or jeopardize the momentum.

“Last quarter, 70% of revenue was generated through our channel partners,” says Anania. “Channel partners are also playing a pivotal role helping maintenance customers move to product subscription.”

More Info

AutodeskSubscribe to our FREE magazine, FREE email newsletters or both!

Latest News

About the Author

Kenneth Wong is Digital Engineering’s resident blogger and senior editor. Email him at kennethwong@digitaleng.news or share your thoughts on this article at digitaleng.news/facebook.

Follow DE