Industry 4.0 Responds to the Pandemic

More organizations turn to digital twins and centralized workflows to address supply chain challenges.

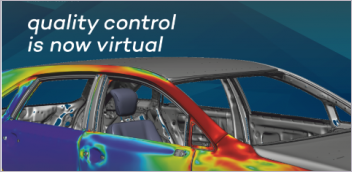

Companies are using virtual reality simulations to ensure that their production lines and operations adhere to social distancing standards. Image courtesy of Siemens Digital Industries Software.

Latest News

December 1, 2021

Manufacturers are in trouble. The COVID-19 pandemic has fractured supply chains, forced factory closings and taken a heavy toll on workforces the world over. As a result, manufacturers have been forced to re-evaluate their operating practices and software tools fundamentally (Fig. 1).

The harsh truth is that manufacturers and their supply chain partners must work hard to adapt to the new landscape. In all likelihood, the manufacturing business models and supply chains of tomorrow will look nothing like their predecessors.

One reaction to this upheaval is to harness the latest generation of Industry 4.0 practices and technologies. These tools promise to empower manufacturers to better manage production processes and the lifelines that support them.

“The worldwide crisis has significantly increased the velocity and appetite for change,” says Dave Vasko, director of advanced technology at Rockwell Automation. “Improvements such as production flexibility and robust supply chain management have become business imperatives.”

Supply Chain Disruption

To understand why these fundamental changes are necessary, consider the extent to which the pandemic has thrown the current supply chain into disarray.

The fact is that the pandemic has torn the very fabric of today’s supply chains, exposing labor limitations, oversaturated dependence on geographies and failed operating mechanisms. These structural flaws manifest themselves in the form of shipping delays, restricted access to raw materials, erratic demand patterns and unreliable delivery and distribution of goods and materials. All these factors have created uncertainty as to how best to continue to design and deliver products.

“Even in sectors where demand and supply were relatively stable, other factors like social distancing and workforce absences due to the virus have caused disruption,” says Adrian Wood, strategic business development and offer marketing director, DELMIA, at Dassault Systèmes. “Overall, it was a perfect storm of unprecedented events that the majority of manufacturers were ill-prepared.”

Time to Make Changes

As manufacturers have started taking the measure of the supply chain disruption, it is a major challenge to identify the best way to counter the effects of the pandemic. This means determining the most effective changes in operating principles and software tools.

Many companies have underestimated the scale of changes required. As a result, their responses have fallen short of what is required to adapt to and flourish in the pandemic and post-pandemic workplaces.

“Manufacturers have not modified their processes enough to counter the supply chain disruptions brought on by the pandemic,” says Peter Bilello, president and CEO of CIMdata. “Most are just trying to deal with it in a tactical way. Hopefully, many will take a more strategic look at their product portfolio, supply chain architecture and other aspects of their value chain and see how to best adjust and future-proof their operations.”

The manufacturers that have taken a more strategic approach are focusing on cultivating greater agility and resiliency. In this context, agility is the ability to run truly lean manufacturing operations that can quickly adjust production rates up or down without adding cost in excess raw materials and work in process.

On the other hand, resiliency represents that ability to weather future disruptions through supply chain optimization and contingency plans. This enables sourcing and manufacturing at multiple locations worldwide so that localized disruption can be mitigated. In other situations, it can mean bringing manufacturing in-house to maintain even greater control.

Greater Visibility Required

To achieve the level of agility and resilience needed, manufacturers must cultivate greater information visibility.

“The pandemic has made it abundantly clear that visibility must be improved, and this is what many manufacturers have been working on,” says Prasad Satyavolu, digital manufacturing and operations, North America lead at Accenture’s Industry X. “Information visibility is the process of sharing data to manage the distribution of products, services and information in real time between suppliers and customers. In an Accenture survey, 87% of supply chain executives agree that multi-party systems are poised to become the center of commerce, supply chain and transactions among partners and customers.”

End-to-end supply chain information visibility promises to drive operational efficiency. For example, let’s say that a manufacturer’s materials supplier will miss a delivery. Receiving this information from the supply chain systems in time allows the factory to assess the implications and, if necessary, pause other operations to ensure they aren’t wasting resources.

“Increasing information visibility has become a priority for businesses during the pandemic, with many having embraced analytics and big data, the Internet of Things, artificial intelligence, cloud, robotics, 5G and mobile connectivity in general,” says Satyavolu. “Although the degree to which they have automated the process of generating higher information visibility varies by business.”

Creating Digital Crystal Balls

The pursuit of comprehensive manufacturing and supply chain visibility has led many companies to embrace digital thread and digital twin technologies. A significant 69% of supply chain executives expect their organizations’ investment in digital twins to increase over the next three years, according to Accenture research.

This growth is from the technologies’ ability to add a layer of context to data that then translates into a predictive power. This capability helps manufacturers achieve more understanding of how assembly processes relate to and interact with underlying procedures, working practices and conditions throughout the supply chain.

After the initial disruption caused by the pandemic, manufacturers started using digital twins to take the real-time view of thread systems and run rapid what-if strategic manufacturing simulations (Fig. 2). These used optimization goals based on constraints at hand, and scenarios included real-life factors, such as increasing or decreasing production, changing manufacturing facility layouts and manufacturing new products and emergency equipment. Simulations also enabled manufacturers to evaluate the impact of new working conditions like social distancing (Fig. 3) and higher-than-normal levels of absences.

“Manufacturers are leveraging digital twin technology to see what’s to come,” says Satyavolu. “Digital twins can help companies model in real time the potential impact of disruptions to find and fix vulnerabilities that could harm the business.”

This visibility has been further enhanced by digital thread’s ability to incorporate data from the Industrial Internet of Things’ growing pool of sensors, which are increasingly used to add intelligence to machinery and industrial systems.

“When you can capture data on equipment and analyze this data within the context of your business, you can detect the unexpected, see previously unseen patterns and even predict issues before they arise,” says Richard Howells, vice president of supply chain at SAP. “This puts you in the position to take swift, preemptive and cost-effective action to fix them.”

Visibility Through Collaboration

An element that goes hand in hand with achieving greater visibility is the use of platforms that facilitate effective collaboration.

Achieving this level of collaboration, however, is difficult—if not impossible—to attain using manual or legacy systems, largely because of their inability to access necessary information. Organizations are, therefore, looking to digital thread and twin systems.

The new digital systems allow companies to merge their engineering efforts into a single common platform. This enables stakeholders and problem solvers from a variety of disciplines, throughout the entire supply chain to cooperate and interact. The single, unified architecture gives all eligible participants access to a common, up-to-date pool of data sources. These sources can range from design and manufacturing databases to information systems residing at the various levels of suppliers and distributors.

“Many factory technicians, automation engineers and manufacturing executives have been forced to work remotely or with limited contact with colleagues and business partners,” says Dassault’s Wood. “Digital twins are naturally collaborative applications that connect disciplines and roles within and among organizations. Despite physical or psychological disconnection, digital twins provide continuity of business by enabling collaborative workflows.”

Alternatives to Physical Contact

Digital twin, however, isn’t the only technology manufacturers and supply chain companies are using to promote greater collaboration to counter the effects of the COVID-19 crisis.

“Manufacturers are using augmented reality (AR) and virtual reality (VR) systems to compensate for travel and in-person interaction limitations brought on by the pandemic,” says Zvi Feuer, senior vice president, digital manufacturing software and CEO of Siemens Digital Industry Software.

An example of this is where manufacturers and their supply chain partners use VR systems to enable employees to work remotely from home. This approach mitigates effects of travel restrictions and facility closings by allowing workers to effectively teleport to manufacturing, warehouse or logistics sites that have been closed to non-essential workers.

AR and VR technologies are being used by BSH, a leading home appliances manufacturer in Europe, to conduct factory planning and decision making. In this case, the company’s engineers and managers meet in VR sessions to discuss processes and the newest developments, sharing the same data and exchanging knowledge and opinions on installations and manufacturing concepts early in the product lifecycle. BSH points out that the practice improves decision-making without the risk of harmful contact.

Remote Testing, Support and Training

VR technology also allows remote workers to test strategies, processes and machinery using simulation. “VR tools like Emulate3D enable companies to build virtual production lines and uncover potential problems before they occur,” says Vasko. “Manufacturers can start to optimize operation before ever installing equipment, and make a fast transition from design to full production, which allows them to pivot quicker to new products based on current demand and parts availability.”

For AR systems, manufacturers have found that they can use these platforms to reduce unsafe physical contact by providing information and expert advice remotely and on demand.

“An AR headset can provide on-site technicians with support from remote support centers, be it human or artificial intelligence,” says Vasko. “AR’s ability to augment real environments with additional virtual information is game changing. Technicians can see additional process information, maintenance data or checklists to perform maintenance or troubleshoot problems.”

Finally, AR and VR systems can be used by manufacturers to remotely train and upgrade the workers’ education.

“Although the use of traditional online meeting tools has risen dramatically, there is still a gap related to training and visualization of operations that is apparent for companies where the workforce continues to be disconnected,” says Wood. “Operator training is one area where AR and VR has helped. Using digital twin models of manufacturing processes and products, it is possible for workers to receive realistic training without stepping a foot into a facility.”

Move Beyond Crisis Management

Most manufacturers and supply chain companies found themselves ill-prepared to effectively deal with the challenges created by the COVID-19 pandemic. To address these challenges, manufacturers must map rapid changes in demand with volatile supply chains. This mapping process should include various key strategies.

For instance, manufacturers should identify and establish alternate sources of materials. This would help prevent overreliance on any single geographic location, precluding supply chain disruptions triggered by local crises.

To help with this course of action, production facilities should also run simulations, leveraging digital twin insights to determine where and what to produce, where to position inventory and how to satisfy demand.

“Simulations will help manufacturers to identify risk mitigation strategies to balance on-shore, near-shore and off-shore suppliers, contract manufacturers and inventory policies,” says Howells.

More CIMdata Coverage

More Dassault Systemes Coverage

Subscribe to our FREE magazine, FREE email newsletters or both!

Latest News