Latest News

December 1, 2013

“About 15 years ago, we developed a product called Virtual Proving Ground,” recalls Abe Keisoglou, president of Engineering Technology Associates (ETA). “It was a unique product, and we really thought that the auto industry would accept it.”

Virtual Proving Ground, however, was not an immediate success.

At the time, says Keisoglou, a rigid body kinematics program called Adams (now owned by MSC) was the predominant product in the auto industry for doing load simulations. “A whole car was about 60 points,” he says. “It’s a very simple model to build, and runs very quickly.”

But to create that model, you first had to build an actual car. “You’d build a prototype,” says Keisoglou. “It costs $1 million, and takes six to nine months. Then you instrument that car, and run through different road conditions at the proving grounds while you capture data on all the loads. You take those loads and build an Adams model, and tune it to match the experimental data from the car. Then you’ve got a model you can use to start making design changes for the car.”

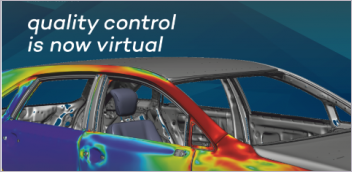

“You can’t do any design for at least a year,” he adds. “So we came up with Virtual Proving Ground. You build a finite element (FE) model of the whole car—instead of having 60 points, you have millions of elements: elements that describe the body, the suspension, the chassis and the road surfaces. You can get results within 10% to 15% of experimental results up front, without building a million-dollar prototype. You save six to nine months in your design cycle up front.”

Keisoglou and his team completed several successful projects with Ford, GM and Chrysler. Top management was excited, each time enthusing “This is a great idea. Let’s do it!”

So how, exactly, did Virtual Proving Ground fail? Top management.

“They didn’t want to make enemies of middle management by forcing things down their throat,” Keisoglou explains. “So they would say, ‘You need to talk to so-and-so middle manager. He needs to implement this himself, so he needs to feel comfortable with it.’ This middle manager’s career is based on a legacy of success with ]Adams]. They had a lot of money invested in the software and the training. They would do everything possible to kill the implementation of our new process. And politically, it became impossible to break through and implement our technology. This was almost across the board in the U.S. auto industry.”

It’s not just management who’s resistant to change, of course. Bill Zavadil, senior vice president at IMAGINiT Technologies, recalls a project with a major equipment manufacturer who had spent millions of dollars to migrate from CADAM to Autodesk.

“Two years later, we walked into the place and the guys were still using CADAM,” he says. “It’s what they were used to. They were getting the job done. One day, ]the company] took that desktop away, and forced them to make the change.

“You’re always going to have people who aren’t going to buy into change,” Zavadil continues. “But the company didn’t try to understand where these guys were coming from. They didn’t explain the logic behind the change, didn’t articulate the objectives behind it. That has to come from the top.”

Until Now, Everything Was Fine

Sometimes, the problem lies in convincing management that potential problems even exist when everything seems to be going swimmingly. Companies often make the mistake of assuming that, since they have created a process that consistently produces good quality products, they understand how that process works.

Nicholas Veikos, Ph.D., president of CAE Associates, poses some key questions: “Do you really understand how your product works? Do you really understand what will happen when you change things? I can’t tell you how many companies we’ve walked into that have changed something in their product and now it didn’t work anymore. They didn’t know what to do.”

Veikos recalls one such company whose business was making foam mattresses. “They had a very old process that had developed over time,” he says. “It worked just fine, and then something forced them to make a change and it stopped working. The one guy who knew how to tweak the thing was long gone and retired. All the company did was make these mattresses, and they had no insight into what was going on. They thought they knew how it worked, but that wasn’t how it worked at all.”

Segregation

“Sometimes,” notes Rod Mach, president of TotalCAE, “the company is segmented in a way that creates these islands of engineering. There’s a CAE group and an FEA group. Or they’ll segment groups by product. That might look good on an org chart, but groups don’t speak to each other and aren’t learning from each other. They each only have a small pool of money. They can’t pool licensing or hardware or brains.”

For example, Mach continues, he was consulting on a project that several different groups within one company were trying to do independently: “They were all going to the same vendors and getting quotes they couldn’t afford. We said, ‘Did you know there are other people at your company doing the same thing? Why don’t you all work together and pool the money to get the tools you all need?’ They were all starving, whereas if they’d pooled their money together, they could have gotten a steak dinner.”

You Want What?

Another big impediment, says Mach, is that management views engineering technology the same way they view a file print resource. They don’t understand why engineers need so many expensive resources: “Engineers just want better toys. Why can’t they run on their laptops like everybody else does?”

“In most companies, IT will try to shoehorn you into ]hardware] they’ve already picked,” he continues. “But these are scientific instruments that take special skills and are solving special problems. Your IT department might not be your best leader to decide what your engineers need to get their job done.”

In addition, management may not always recognize expenses. “A lot of the focus at companies is on the spending side,” says Mach. “The ROI calculations often don’t consider labor and time to market.”

Take simulation run times, for example. “People get accustomed to engineers sitting around for a week waiting for an answer,” says Mach. “They see the capital expenditure of getting a better resource in place—a cluster or what-have-you—as an immediate expense, but they don’t see the value of getting the results faster, of the engineers not sitting around waiting. If you’re paying 10 engineers $100,000 each, you’re paying $1 million to have those engineers idle in order to avoid a $100,000 capital expenditure.”

To get management’s attention, says Mach, you need to quantify the improvement. Maybe the engineer won’t be sitting and waiting for results as often, but what are you going to do with the time that you freed up? What are the benefits? Because the costs—the software, the hardware, the process, the consultants—are all too visible.

“Engineer-speak doesn’t always translate up the food chain to the people who sign the checks to fund these initiatives,” says Mach. “Don’t say, ‘I can do 1,000 runs.’ Say, ‘We can make our product X percent lighter than the competition if we have this tool,’ or ‘We’ll get the answer 10 times faster, which will impact design and save money on testing.’ That seems to be a better understood metric.”

That can be hard to do, he admits: “You’re setting yourself up for more work.”

Be a Champion

“There’s always resistance to change,” says Mach. “Always. Even if the change is better, people naturally resist change.”

Mach adds that for big companies especially, it’s not usually one person’s decision to adopt something new. If you can’t find a champion, somebody who’s really going to lead, then it takes just one person to negate the idea for it to completely disappear.

“You need someone with enough political capital to take a few bruises. Without that champion, without having someone who’s really invested and can make other people believe in the change, it’s very different to get things changed internally,” he says.

To get management buy-in, says CAE Associates’ Veikos, you have to be able to quantify the benefits. “There’s no better way than some kind of pilot project,” he says. “Find something that’s not going to take the company down if it goes wrong, so nobody gets nervous, and then go through the process. Develop metrics for what success is, before you start, and then measure everything. At the end of the day, you’ll have a very good comparison: Here are the quantifiable benefits that you’ve achieved, how much money you saved in the design process, how much time you’ve saved. Many times, that’s sufficient to change the mindset.”

“You have to stick your neck out and be proactive,” agrees ETA’s Abe Keisoglou. “You’ve got to take the lead. You have to take chances. Find out what the new technology is, and how to bring it into the organization with the intent of helping the company be more efficient and more profitable.

“Be a visionary. If you see something that needs to be done, go out there and make it happen.”

Contributing Editor Mark Clarkson is DE’s expert in visualization, computer animation, and graphics. His newest book is Photoshop Elements by Example. Visit him on the web at MarkClarkson.com or send e-mail about this article to de-editors@digitaleng.news.

More Info

Subscribe to our FREE magazine, FREE email newsletters or both!

Latest News

About the Author

Mark ClarksonContributing Editor Mark Clarkson is Digital Engineering’s expert in visualization, computer animation, and graphics. His newest book is Photoshop Elements by Example. Visit him on the web at MarkClarkson.com or send e-mail about this article to DE-Editors@digitaleng.news.

Follow DE