AM Market Outlook Bumpy, but Bright

Experts tracking the progress in additive manufacturing point to positive signs while citing some cautionary challenges ahead.

Photo courtesy of Getty Images.

Latest News

January 10, 2025

The additive manufacturing industry, as it matures and evolves, has proven it can weather global storms, be they in the form of pandemics, politics or economic ebbs and flows. In the past year, the industry has experienced its share of mergers and consolidations while technologies have brought new applications to the table, leading to growth in industries not previously immersed in the additive manufacturing (AM) space.

From a numbers standpoint alone, continued growth seems to be the expectation at least in the 3D printing market. That market, based on sales of 3D printers and 3D printing materials, is expected to hit US$49 billion by 2034, at a compound annual growth rate of 11% between 2024 and 2034, according to IDTechEx in its latest report, “3D Printing and Additive Manufacturing 2024-2034: Technology and Market Outlook.”

Additionally, in research conducted by Protolabs, the company projects that the 3D printing market will grow to reach $57.1 billion by the end of 2028. It also found 82% of respondents said 3D printing helped them save significant money, and 77% point to 3D printing having the biggest impact on the medical industry, among other key findings.

But beyond published reports, DE touched base with several leading vendors and an analyst in the industry to gain a greater perspective on AM’s outlook for the near and distant future.

Dim and Brights Spots in AM’s Future

“As we step into 2025, the once-promising skies of the 3D printing industry seem overshadowed,” cautions Bart Van der Schueren, chief technology officer of Materialise. “Investments have slowed, fewer startups are emerging, and many publicly traded companies struggle to make a profit. Our industry continues to grow, but only a handful of companies are seeing positive revenues.”

Balancing that sobering outlook, Van der Schueren expects use of 3D printing to shift in the way that it’s used. “3D printing won’t drive industrial transformation on its own, but it can provide opportunities to grow in new ways. Think of it as a supporting actor in a movie—essential to the plot but revolving around the main character. While legacy methods will continue to lead, 3D printing can play a vital supporting role by enhancing efficiency and flexibility.

“The technology stands at the crossroads between innovation and practical application,” Van der Schueren adds, suggesting the focus should be on moving from innovation to widespread industrial use.

Over at Siemens, Aaron Frankel, vice president, Additive Manufacturing Software Program, sees the AM industry in a state of transition, with promise for the future. “AM is moving from a period of hype with inflated expectations to initial maturity, where its potential remains substantial.”

On the other hand, Frankel doesn’t neglect to note AM’s business challenges. “Some of the potential roadblocks/bottlenecks that I see include the high cost of tech and app development, slower-than-anticipated adoption rates, the lagging development of supply chains, targeted investments and the continued consolidation of machine OEMs, software and solution contract providers.”

Meanwhile, Terry Wohlers, head of Advisory Services and Market Intelligence, Wohlers Associates, powered by ASTM International, sees time and costs as ongoing challenges for AM. “The challenges are (a) driving costs out of AM materials and systems, (b) the lengthy time and high cost of qualification and certification, and (c) the time it takes to develop and adopt industry standards. Qualification and certification of processes, materials and designs is slowing adoption.”

nTop’s Bradley Rothenberg, CEO, sees light at the end of AM’s tunnel, despite any current challenges. “The future is bright for AM because engineering teams are facing unprecedented pressure to accelerate time to market for new products and AM doesn’t require the long lead times typically associated with tooling for traditional manufacturing methods. Across industries, we’re seeing engineering teams adopting computational design to enable faster design, development and validation of product designs.”

Optimism also runs high over at Protolabs, where Ryan Kees, Protolabs 3DP Global Product Director, comments, “We are already seeing more of our customers turning to 3D printing for end-use production work. That was not the case only a few years ago. Within the industry, companies are driving innovation with the introduction of new materials that address specific needs. Meanwhile more product developers are finding areas where additive manufacturing can help them solve difficult challenges.”

But he doesn’t mince words about obstacles. “Pricing compared to traditional manufacturing is at times prohibitive,” Kees says. “Challenges continue in overall education of how to best use additive manufacturing as well. For example, the illusion that AM can solve all manufacturing needs is incorrect and instead AM has its targeted applications. From an overall industry perspective, oversaturation of OEM and printer manufacturers also makes it difficult to identify the best application for a specific technology.”

“AM is moving from a period of hype with inflated expectations to initial maturity, where its potential remains substantial.” —Aaron Frankel, Siemens vice president, Additive Manufacturing Software Program. Image courtesy of Siemens.

AM Trends to Watch

Siemens’ Frankel is keeping a watchful eye on materials innovation, automation and AI integration, customization and personalization, and sustainability. “As AM matures, I expect increased introduction of applications, deeper integration with AI, and greater support for sustainable, localized, and highly customized manufacturing,” Frankel says.

Protolabs’ Kees suggests AI is only beginning to make its mark: “AI could ramp up even faster as companies and individuals become more comfortable with the technology and its abilities.”

On the software side, Materialise’s Van der Schueren says, “We expect to see more 3D printing software providers opening their technologies to enable users to create custom workflows and gain greater control over hardware settings to meet specific production demands. This will allow users to choose what they prioritize—efficiency, quality, cost, speed or something else.”

Van der Schueren also envisions a breakdown of any barriers to future 3D printing adoption in manufacturing.

“… Many companies still lack the in-house knowledge and expertise to integrate 3D printing into their production processes,” he says. “It’s up to 3D printing technology providers to help manufacturers address these concerns. Collaboration within the 3D printing community is critical to enabling adoption within manufacturing. Our industry must unite to define standards, simplify adoption processes, remove complexity and make 3D printing cost-effective and accessible.”

Monitoring the industry as a whole, Wohlers likens the state of AM to a well-established industry. “Similar to the automotive industry (e.g., transition from internal combustion engines to all electric), we will see a maturation of AM for many decades to come. Expect further improvements in systems, materials and applications. Qualification, certification, and industry standards will help with adoption, especially in aerospace, healthcare, automotive, and energy. This will drive maturation and innovation,” he suggests.

He also suggests watching China’s actions in the additive space. “…China has caught up and quite possibly surpassed the development and adoption of AM for production and other applications.”

nTop’s Rothenberg also anticipates collaboration playing a greater role in the future.

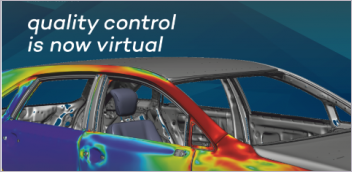

For example, Rothenberg shares how nTop customers increasingly use physics data to inform and optimize their designs for additive manufacturing. “Companies like Cloudfluid, Hexagon, and Intact are integrating their simulation tools directly into nTop, and our integrations with Materialise and Autodesk are making it possible to manufacture these high-performance designs without meshing, faster, and with greater precision.”

3D Printing Expands Further in Industries

Van der Schueren expects 3D printing’s increasing potential to make inroads in healthcare, specifically in customized medical device development. In aerospace, he sees “growing opportunity” for 3D printing to develop non-flight-critical components. He also cites mobility as an area to watch.

“In mobility—spanning trains, trucks and ships—prototyping has been the primary application. Increasingly, however, 3D printing can support the development of energy-efficient drive trains and engines, paving the way for more sustainable transportation solutions.”

Wohlers points to potential growth in the construction industry. “Some believe the construction industry is ripe for innovation. Additive construction (AC) brings new ideas and opportunities that the industry has only begun to explore. It is currently at work trying to find and apply ways AC can add real value. Whether it is architectural aesthetics, structural or something else, the industry will determine ‘sweet spots’ that make it interesting and viable,” he says.

M&A Here to Stay

Mergers and acquisitions are expected to still play an active role in the future of 3D printing.

One driver of this is the high cost of 3D printing, suggests Van der Schueren, which limits potential applications. “By increasing scale through acquisitions, companies can reduce these costs, making 3D printing viable for a broader range of production applications.”

Additionally, he says, “Consolidation allows companies to streamline operations, improve profitability and ensure sustainable growth to support ongoing innovation. In this environment, non-profitable companies may seek acquisition as a path to stability.”

Despite the role M&A plays, Van der Schueren says the industry must keep the focus on scaling usage of 3D printing. “Rather than centering solely on M&A, our efforts should prioritize expanding the reach and application of 3D printing technology.”

Wohlers concurs, potentially indicating that companies in AM will thin out over time. “Thousands of AM companies have emerged worldwide over the past 30+ years. Many of their founders and owners are looking to exit through M&A,” he predicts.

Protolabs’ Kees also chimes in: “There are a lot of players in the OEM space, and consolidation is likely to continue, especially as investment dollars run dry at startups.”

Optimal Design Technology Outlook Study Findings

In DE 24/7’s “Technology Outlook 2024” survey, 220 respondents shared input on what they viewed as most influencing their product design and development. Teasing out a few findings specific to additive manufacturing (AM) and 3D printing, the survey revealed that of this year’s responders, 42% are just somewhat familiar with AM-related technology (followed by 36% very familiar, 17% who have heard of it but are not very familiar, and 5% not at all familiar or have never heard of it).

AM (34%) ranks fourth behind AI/machine learning (64%), simulation software (43%) and high-performance computing/cloud computing (36%) regarding which technologies are expected to have the biggest impact on product development in the next 5 years.

The survey gave space for reader input, asking “What impressions do you have of additive manufacturing/3D printing? What impact do you think it could have on your product designs and development?”

Several anonymous responses include:

“Additive manufacturing along with AI is the next big frontier. We don’t use it much yet, but I suspect over time it will become more commonplace with where I work.”

“Best thing since sliced bread. Being more often than not a ‘one off ‘ facility, printed prototype and product is nothing shy of a God send.”

“I’m of the opinion that additive manufacturing, or 3D printing, is like having a magic wand in our lab. It allows us to create physical objects from digital designs, making prototyping and small-scale production much faster and more flexible.”

“This is getting better and better every day. I think eventually someone will put AI into the software to make Skynet a real possibility, especially when using the metal 3D printers.”

When asked how and why folks are using AM/3D printing in product design and development, responders shared examples: bottles and package designs; small parts; in-house tooling; bumper pads and grippers; containers for shipping delicate items; jigs and fixtures; parts representing cast aluminum shapes; physical prototypes for human interface verification.

A percentage breakdown of how folks are using AM/3D printing is: prototyping (82%); testing (68%); end-use parts (48%); and 19% for “other” uses.

Lastly, 49% of respondents strongly agree that additive manufacturing/3D printing will revolutionize the design engineering process (with 48% remaining neutral about such a notion); just 4% disagree.

More Materialise Coverage

More nTop Coverage

More Protolabs Coverage

More Siemens Digital Industries Software Coverage

Subscribe to our FREE magazine, FREE email newsletters or both!

Latest News

About the Author

Stephanie is the Associate Editor of Digital Engineering.

Follow DE